New Income Tax Rates In Ghana 2025. Year 2025 chargeable income gh¢ The ghana revenue authority (gra) has released the new tax tables effective 1 january 2025.

This amendment to the income tax act, 2015 (act 896) revises the rates for income tax for individuals as provided in subparagraph (1) of paragraph (1) of the first schedule to act 896. 1) monthly progressive tax rates, from zero to 35 percent, for resident individual taxpayers;

Withholding Tax Rates In Ghana 2025 Image to u, Income tax amendment act, 2025 and the growth and sustainability.

.png)

Tax Rates 2025 Ghana Image to u, 2) act, 2025 (act no.1111), aim to adjust the rates and thresholds of.

Ghana Tax Rates 2025 Image to u, After the amendment was passed in december 2025, the ghana revenue authority (gra) stated that the new income tax rates and minimum chargeable income would start on january 1, 2025.

Tax in Ghana How to calculate Latest Ghanaian Business News, Reform agriculture sector for job.

How to compute the new (2025) Employee Tax (PAYE) in Ghana, Income tax amendment act, 2025 and the growth and sustainability.

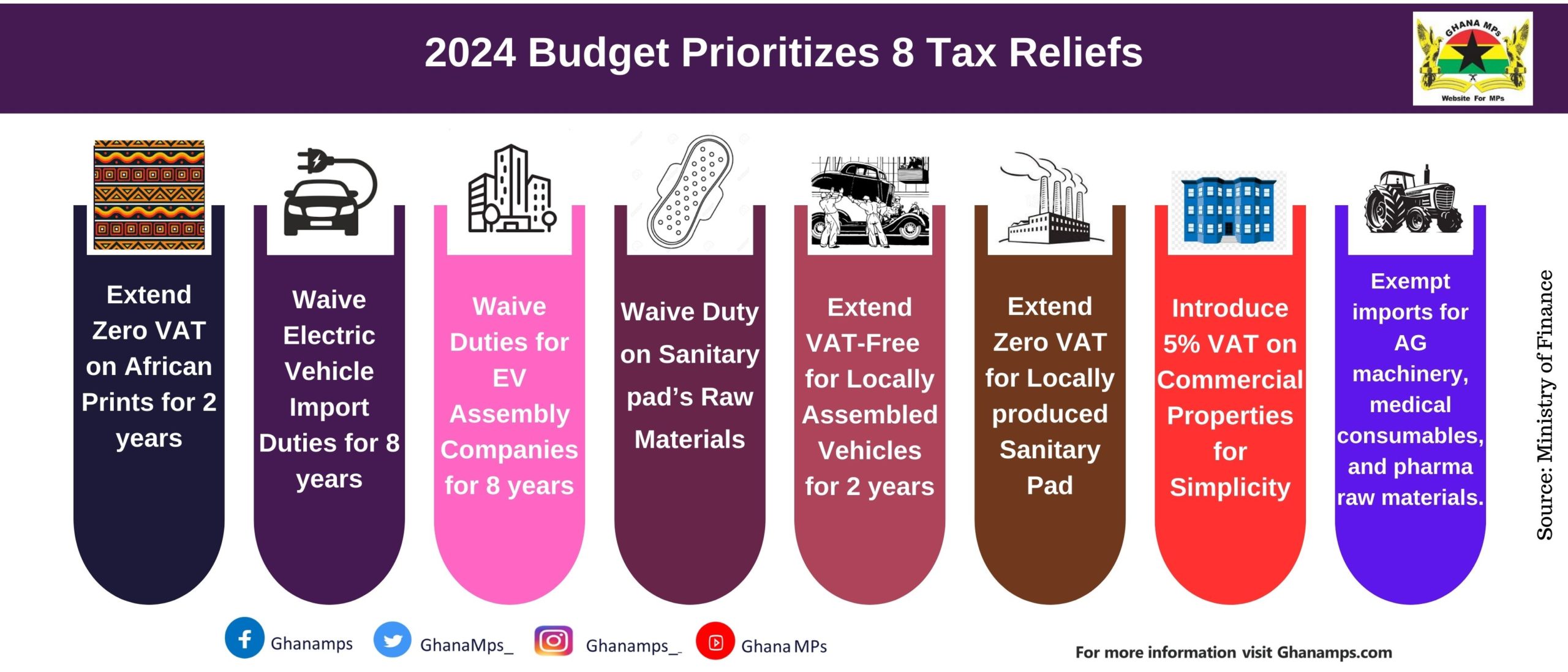

Ghana Annual Tax Calculator 2025 Annual Salary After Tax Calculator, According to recent reports, ghana enacted legislation for the 2025 budget on 29 december 2025, including the value added tax (amendment) act, 2025 (act 1107), the.

Ghana Amends Tax Payroll Outsourcing in Ghana Mercans, The ghana revenue authority (gra) has released the new tax tables effective 1 january 2025.

How to compute the new (2025) Employee Tax (PAYE) in Ghana, The income tax act, 2015 (act 896) is amended in the first schedule by updating the rates of income tax for individuals: